Welcome

Welcome to the PagoNxt Customer Portal user guide. This portal empowers you to efficiently manage your organisation's daily payment operations. You can inquire about payment details, check payment statuses, make manual payments, handle any payment exceptions, and export payment information.

The purpose of this guide is to assist you in navigating the portal's functionalities. It is complemented by technical documentation available in the PagoNxt Payments Developer Portal, as well as the Support Model documentation. We hope you find this guide helpful, and we encourage you to provide any feedback directly to your implementation manager.

Set up and Log in

During the onboarding process, your organisation will establish an authentication method with PagoNxt, known as Single Sign-On (SSO). This process utilises your corporate email and password, which you will use each time you log into the portal. The SSO procedure is essential, as it guarantees that only authorised users can access the information and tools available within the portal. This approach helps maintain the security and integrity of the data, safeguarding sensitive information from unauthorised access.

To access the portal and log in, please follow these steps using your corporate email and password:

Navigate to the URL you were given by your client service team via the web browser to access the customer portal website. A welcome screen such as the following will appear:

Click ‘Login’ and enter a valid corporate email and password and click on the second ‘Login’ button.

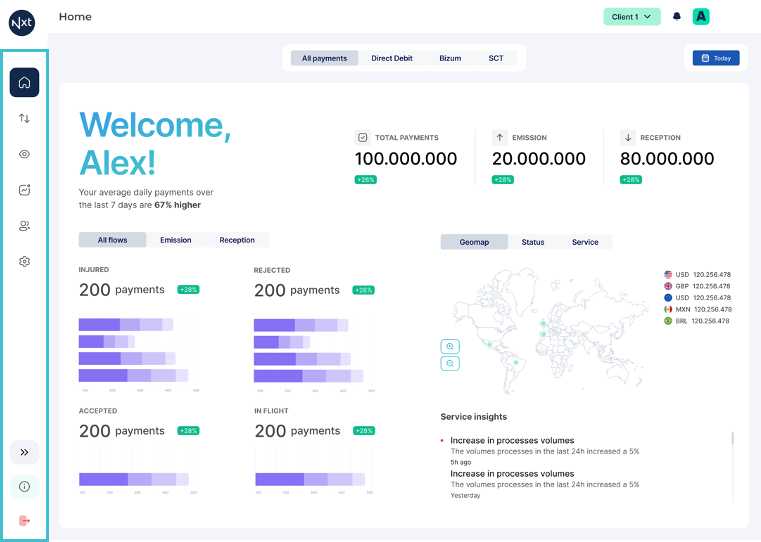

Once the credentials have been validated, the home screen will appear and a confirmation of your active profile will appear in the top right corner.

Any errors during the login process will automatically pop up e.g. invalid credentials.

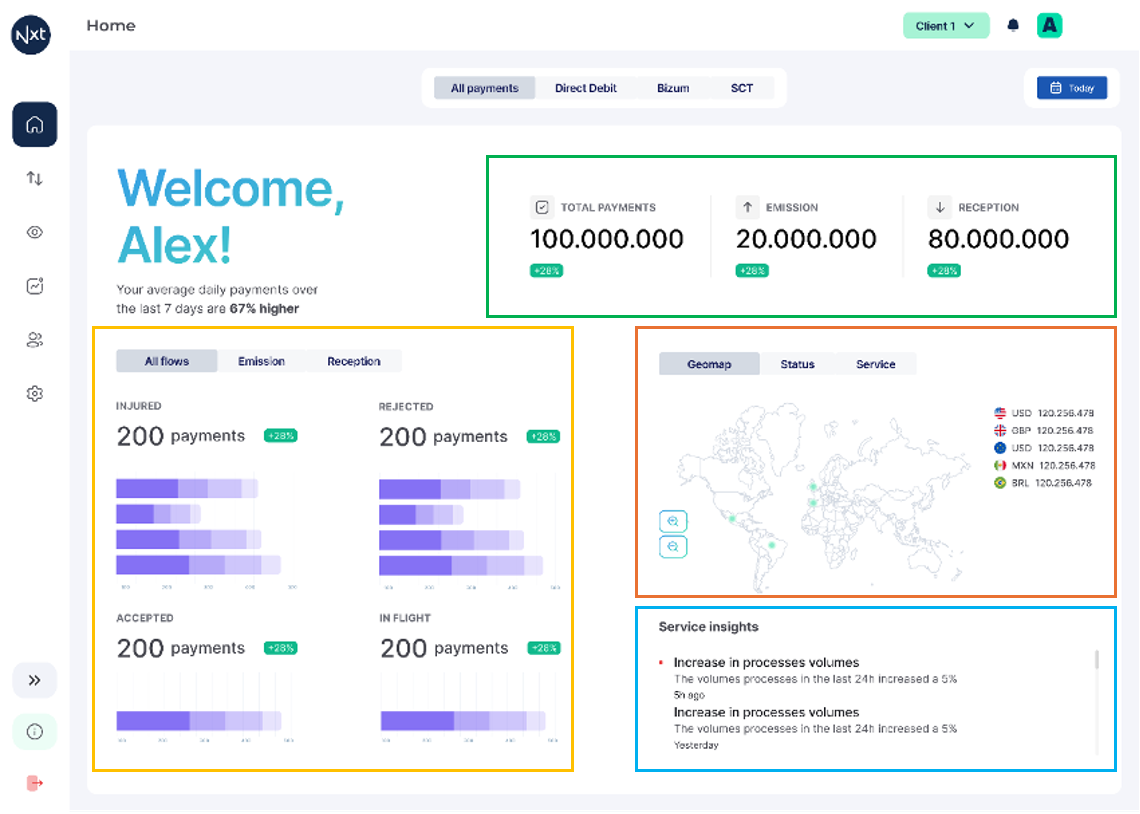

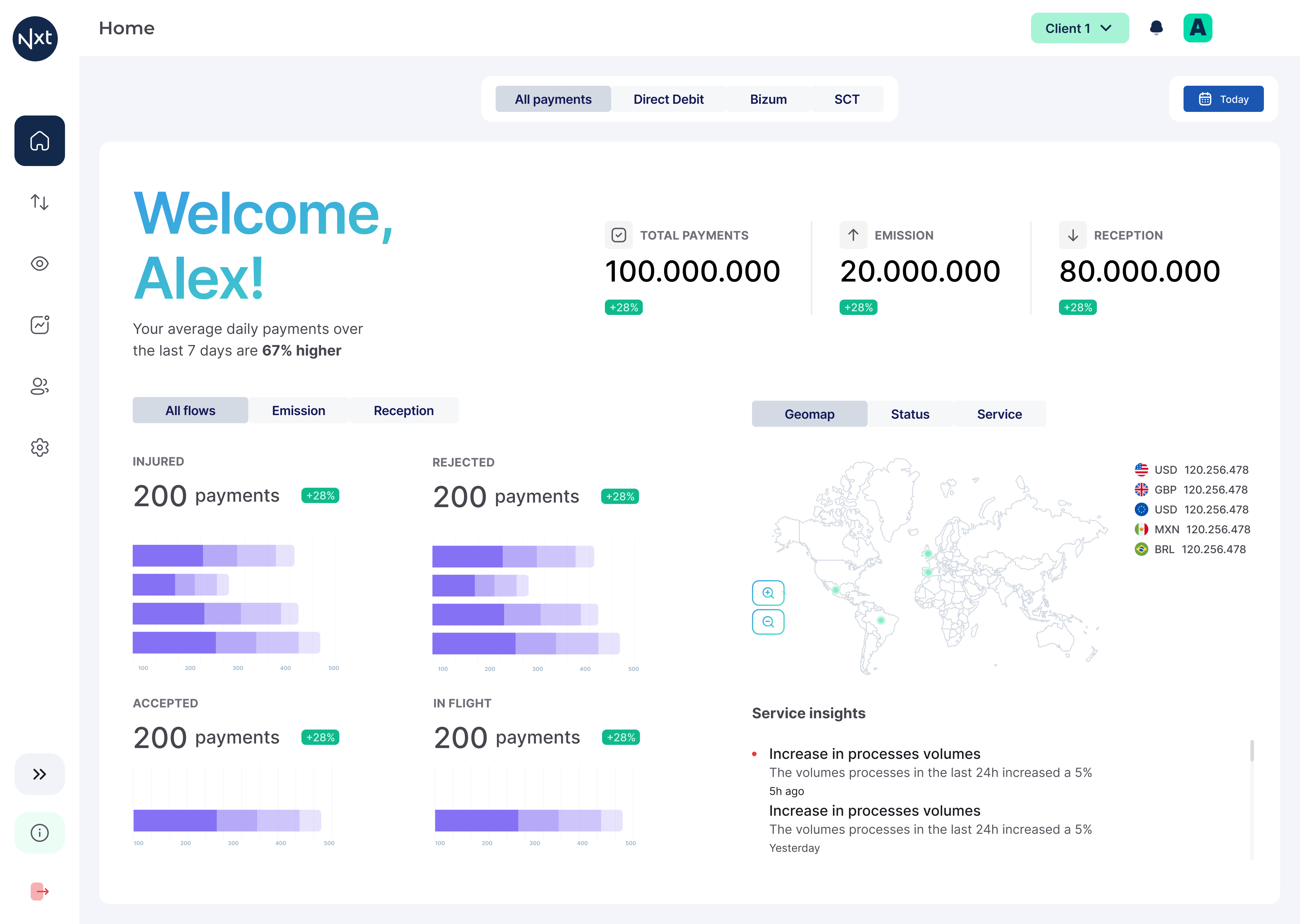

Home page

The Home Page provides a real-time, high-level overview of all processed payments, effectively highlighting areas that require attention. Featuring drill-down capabilities and one-click access to detailed information, it enables you to concentrate on what matters most, facilitating smooth operations and rapid issue resolution throughout payment flows.

The Home Page is organised into four main sections:

Day Summary: View the total amounts of payments processed.

Status Section: Examine payments received or issued, categorised by status.

Main Information: Access a dynamic overview of payments processed by geography.

Insights: Receive a summary containing the most pertinent information tailored for you.

Main menu

The home screen of the customer portal is designed with a main menu on the left side, featuring links to key functionalities such as home screen, payments lists, dashboards or others.

These sections and some of their main features or actions you can take are detailed below.

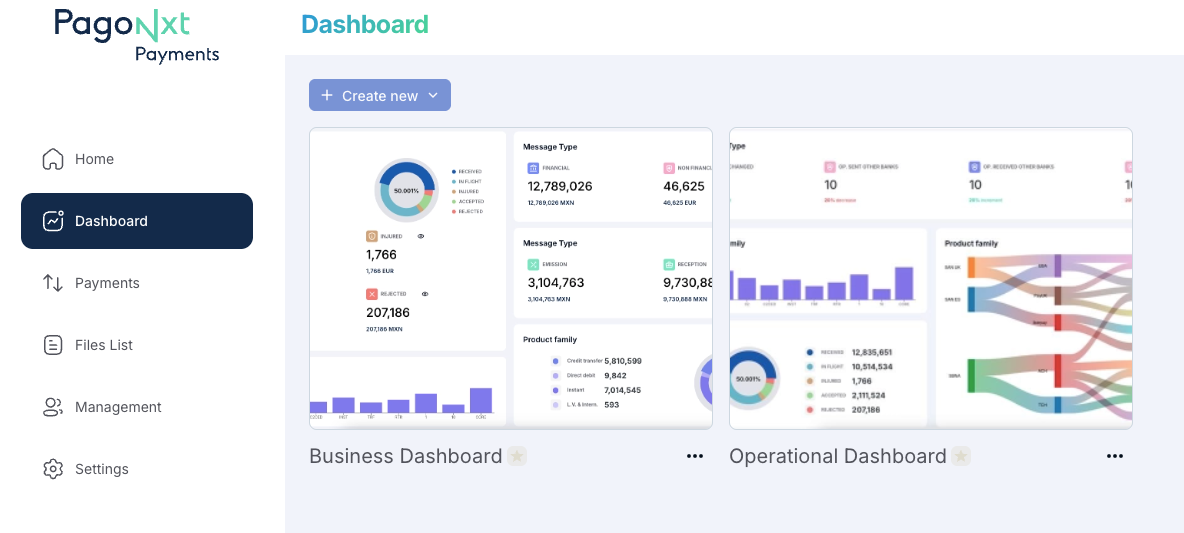

Dashboards

The Dashboard feature enables you to customise the reporting information that matters most to you. Two standard dashboards, namely 'business' and 'operational', are already available. However, you can easily create a personalised dashboard by clicking the 'create' button located at the top of the page.

Payments

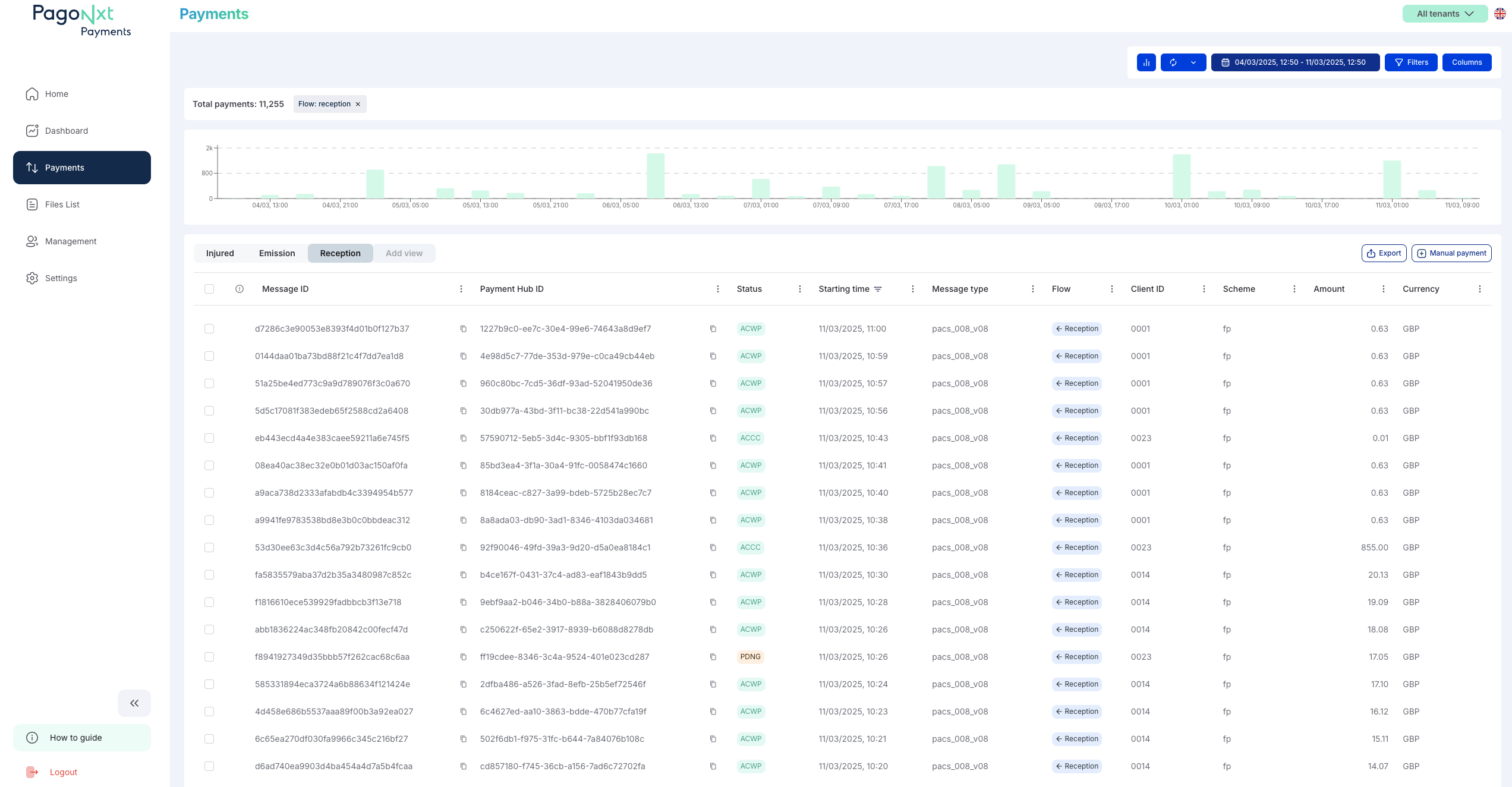

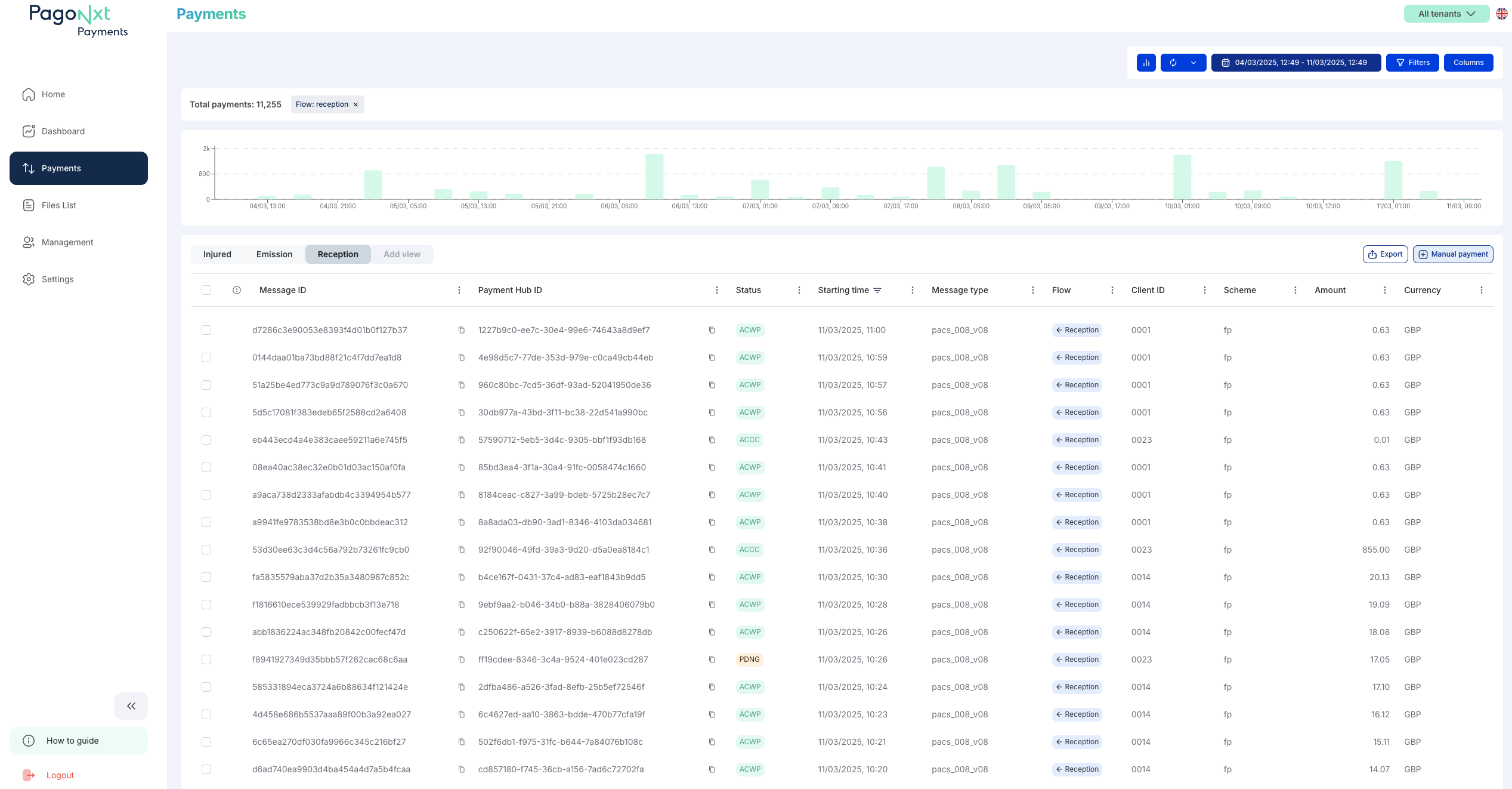

Payments list

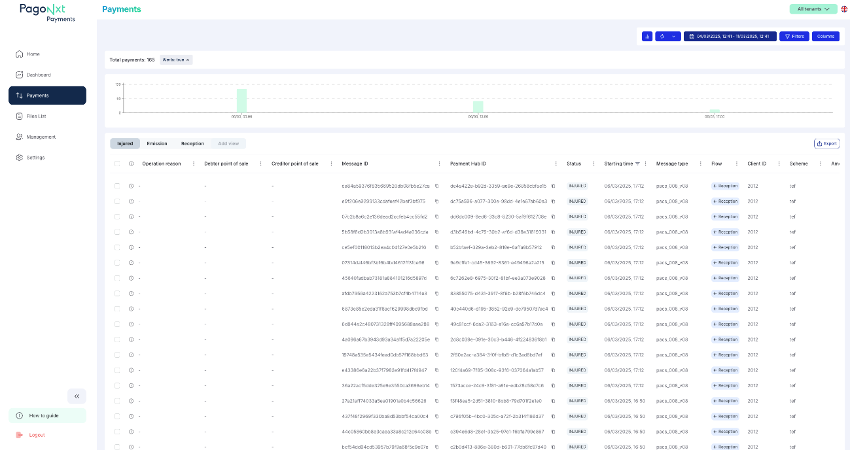

The Payment List section enhances operational efficiency by minimising the time spent on locating and/or resolving payments, thus improving the accuracy of the operator’s work.

In this view, an operator can:

Quickly identify payments of interest that require manual actions or have specific statuses.

Execute remediation actions and address payment issues with minimal friction.

Retain context through filters and seamless navigation to detailed payment views.

Payment search

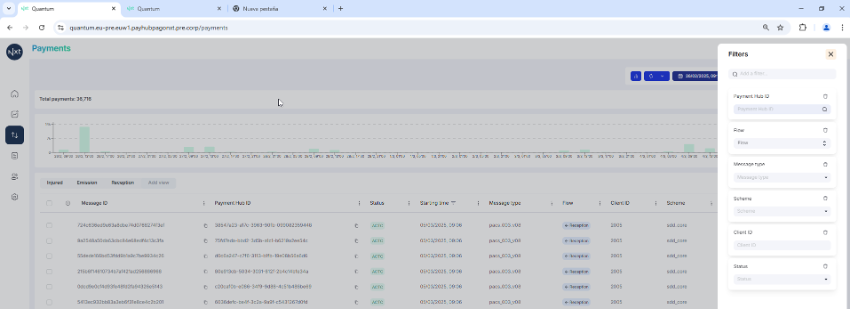

Operators can utilise the payment list to apply various filters in their search for specific payments.

By default, the primary filters are available; however, additional filters can be easily added, provided the data is indexed—something that occurs 99% of the time.

Here are some useful filters:

Payment Hub Id: This is the unique ID assigned to the message as soon as it is registered in the Global Payment Hub.

Message Type: Specify the type of message you wish to query, such as pacs.008 for payments or pacs.004 for returns.

Flow: Indicate whether you are searching for emission (outgoing) or reception (incoming) messages.

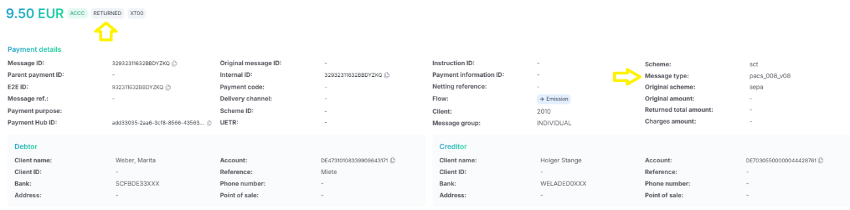

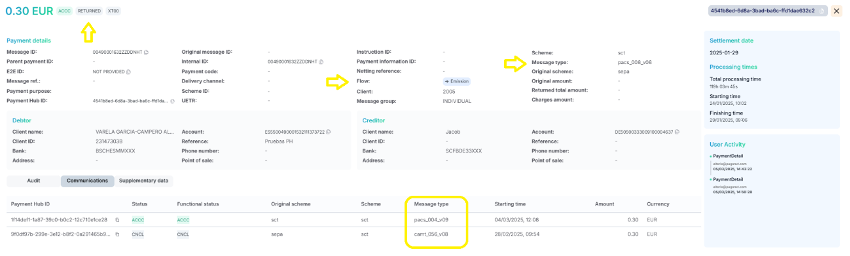

Understanding payment details

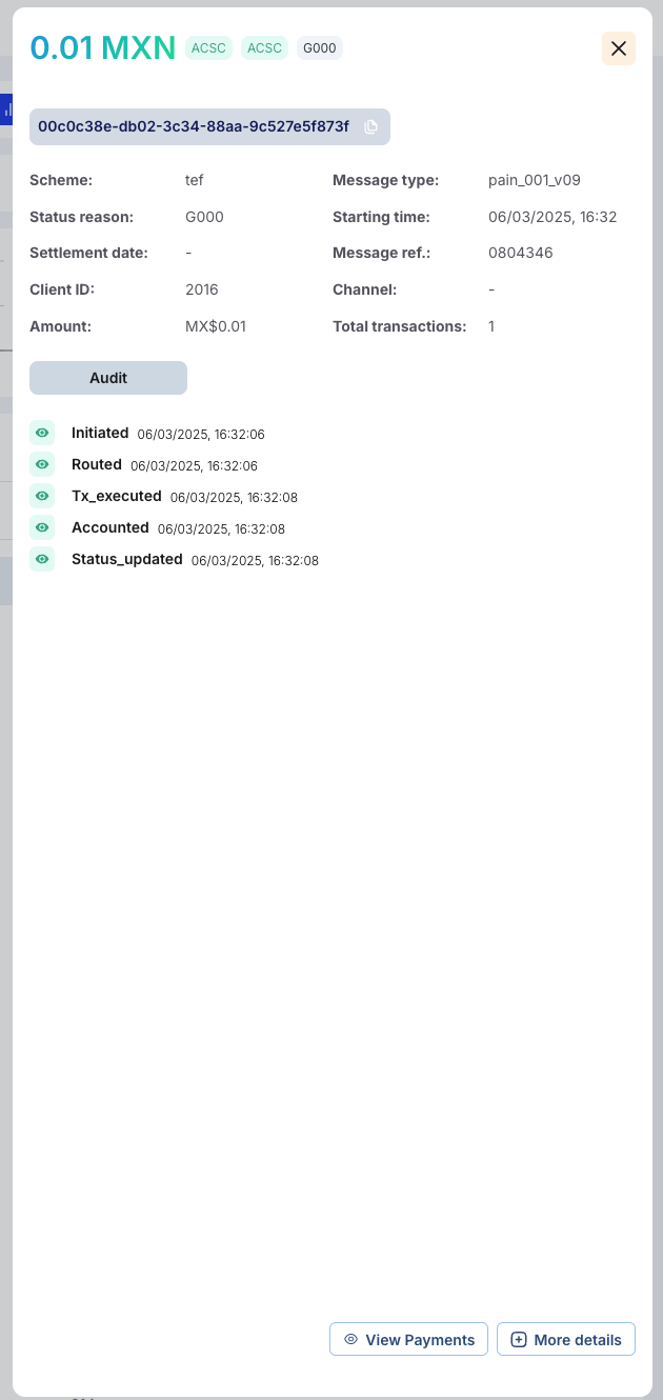

You can easily navigate the payment list and click on a specific payment to find detailed information about the payment, which includes essential elements such as the message ID, creditor and debtor details, and payment timings.

There are two methods to view payment information:

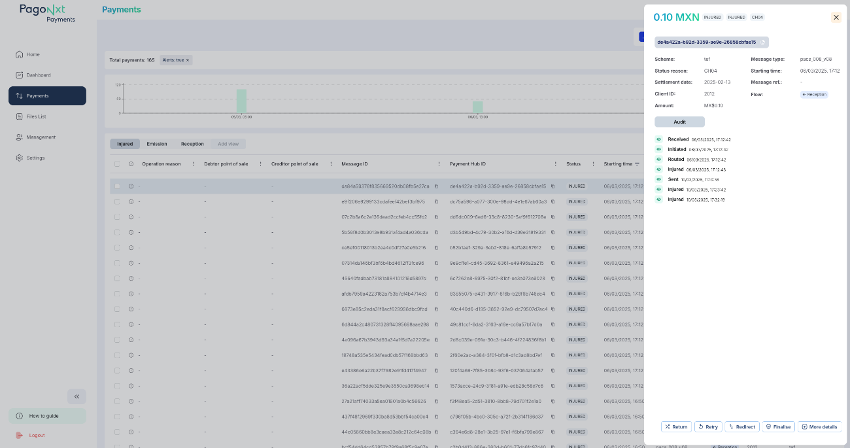

Click on the listed payment. This action will display a snapshot of the payment details in a pop-up box on the right side of the page.

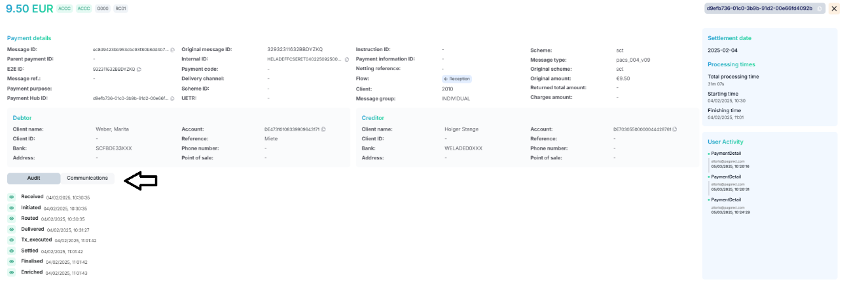

While in this view, clicking the 'More details' button located in the bottom right corner will present a comprehensive overview of all the payment information.

The main information area is organised into three sections:

Debtor Details

Creditor Details

Payment Details

Other areas of information are:

Time and Dates: This section presents information regarding the processing time of the payment and the settlement time

Audit: Here, you can review the events associated with the payment processing. You can also access detailed information by clicking on the icon to view the event JSON.

User Activity: This section displays all user actions related to the payment, providing a complete record of user activity.

It is important to understand that the Audit Trail provides a comprehensive answer to the question, “Where is my payment?” Essentially, it details the orchestration steps that a payment undergoes, listing each step taken throughout the process.

For instance, the image below displays a reception of pacs.008 that was initiated, followed by the validation of 847. Additionally, the screening was validated, and ultimately, the payment was credited to the beneficiary, marking it as settled.

Manual Payment creation

When to create a Manual Payment?

Manual payment creation allows users to initiate payments directly within the platform when automatic processes are not applicable or a manual intervention is required. This feature ensures flexibility and operational control by enabling users to create payments that adhere to the organisation´s specific requirements.

Who can make a Manual Payment?

The ability to create a manual payment is governed by user roles and permissions. Only users with the necessary authorisation can access this feature of submit and approve or reject a payment.

How to make a manual payment?

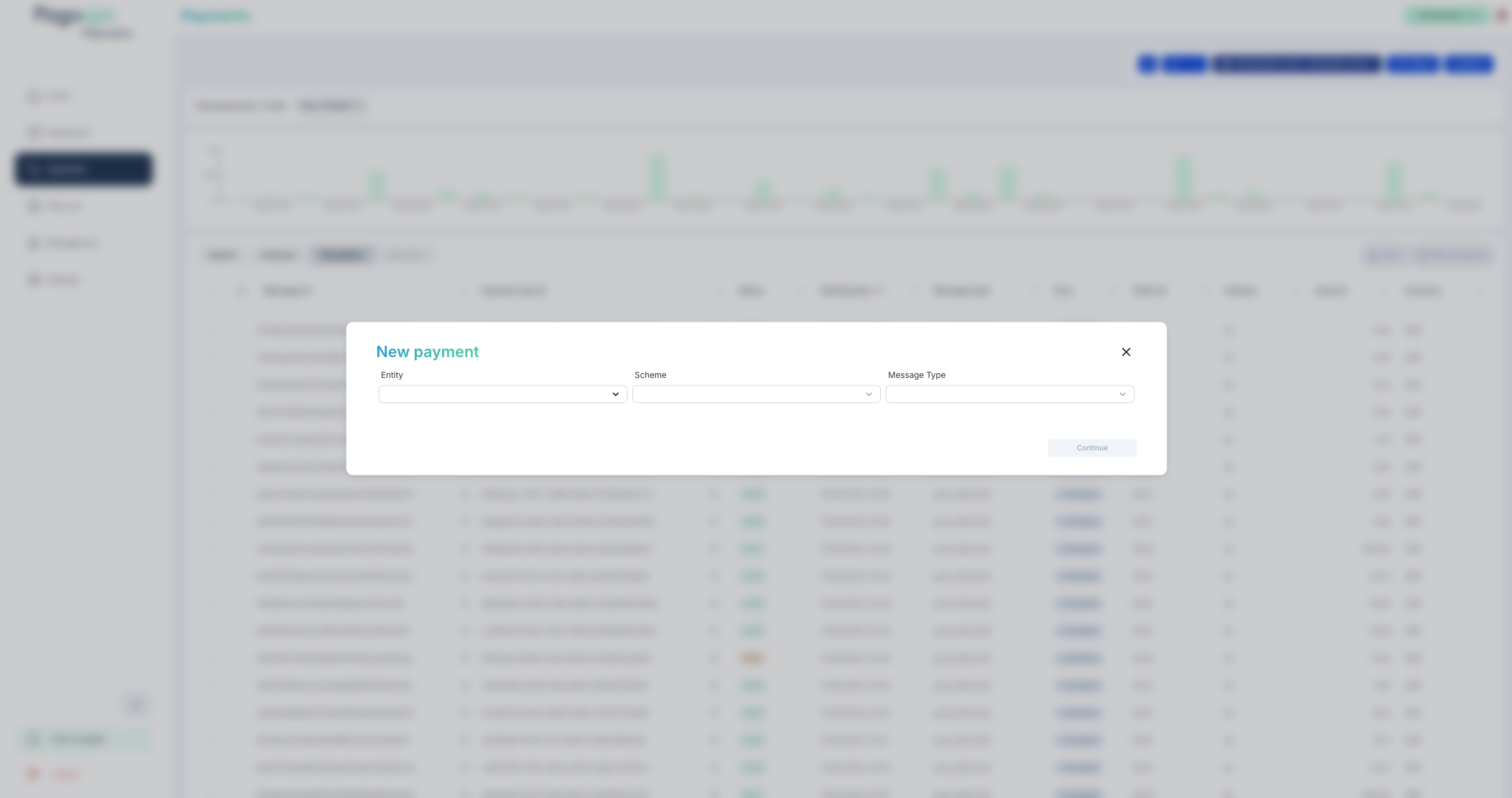

In the right hand navigation, click on the ´Manual payment´button.

When you select this option, a screen will appear. To create a manual payment you should select an option from the three drop down lists:

Entity: the tenant you are sending the payment from e.g. Name of your organisation

Scheme: the scheme you want to create the payment in e.g. Faster Payments

Message: the type of message for the payment e.g. Pacs 008.

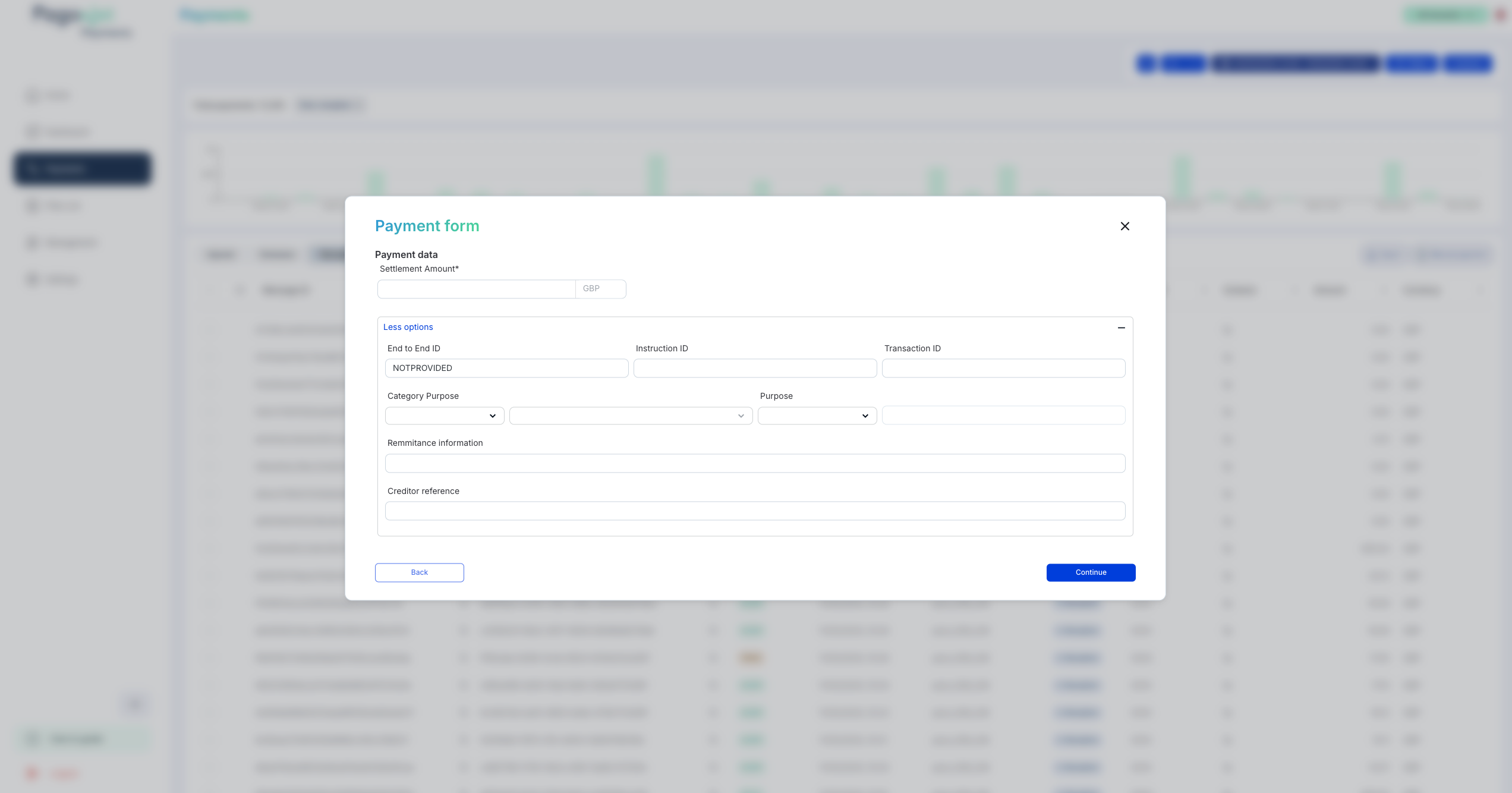

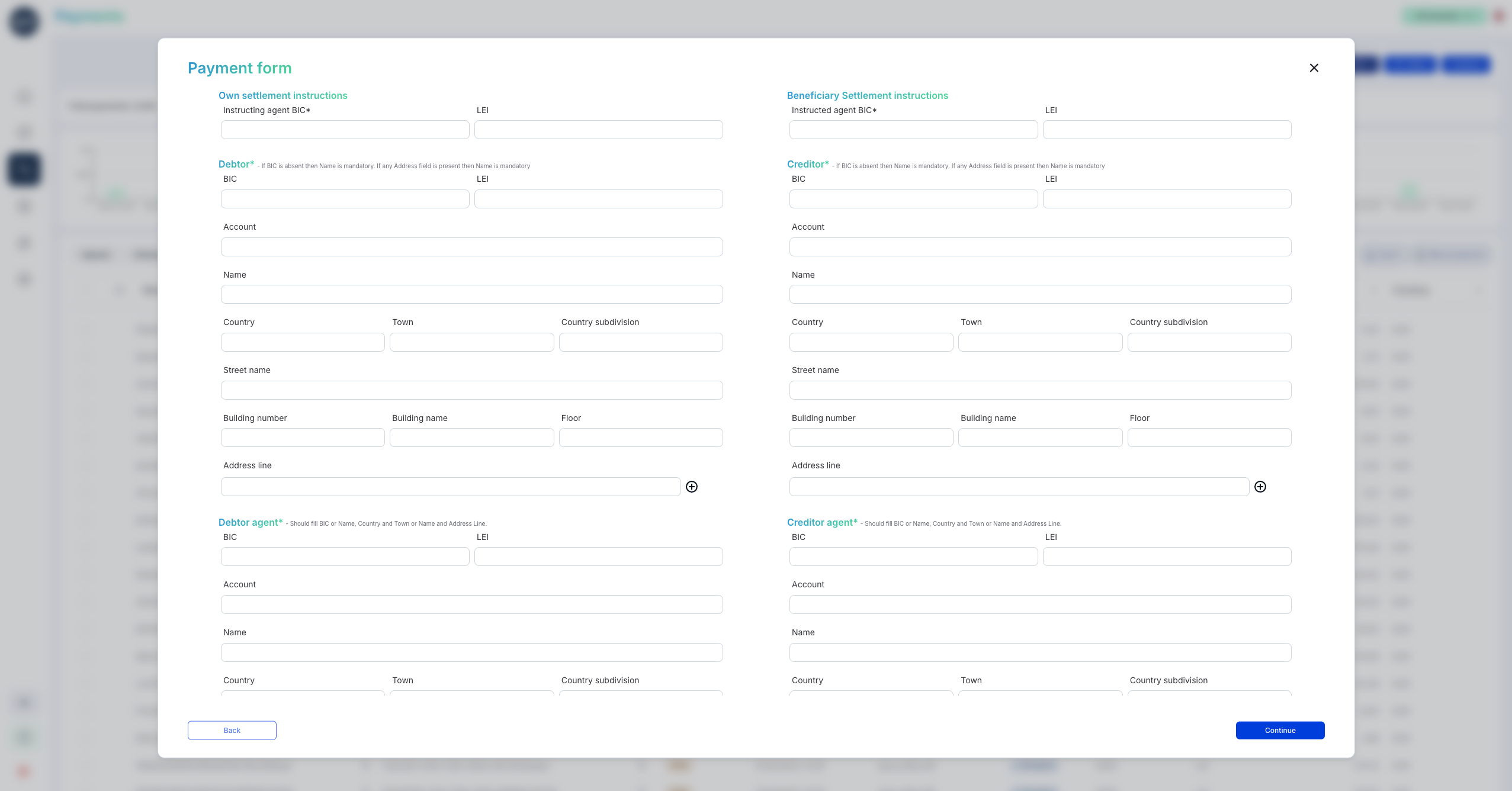

When you have completed this first step, a form with the ISO field will be generated to create a new manual payment where you will need to complete the information using the drop down lists and free text fields. Note: Please check the free text fields carefully before pressing ´continue´.

Exception handling

Payments may need exception handling when they fail validation checks, experience processing issues, or require manual intervention for compliance or operational purposes. In such cases, the system will flag these payments as “injured,” indicating that they require attention before advancing further in the payment lifecycle.

Who can utilise the Exception Handler?

The actions available within the Exception Handler depend the user’s role and permissions within the system. Certain actions may be restricted to operators with specific authorisations.

Actions within the Exception Handler

When a payment is flagged as injured, users can take one or more actions depending on their permissions, the relevant scheme, and the specific issue affecting the payment. The following actions are supported by default and will be available according to the payment flow, whether it is outbound or inbound:

Authorise: Approve the release of a payment that is pending authorisation (4-6 eye check).

Release: Manually release a payment that was previously on hold or required additional validation.

What is the difference between authorize and release? Authorize requires a higher degree of authority. For example, payment will be authorized by a supervisor and will be released by an operator.

Reject: Permanently stop an outbound payment from being processed and notify the originator, typically used when there are compliance concerns or incorrect payment details.

Repair: To update the outbound payment with new data that will fix it. The fields that could be repaired are New Settlement Date, Category purpose and Remittance Information. Repair will start the orchestration of the payment from the beginning with the new data. For example, if the payment had done AML validation befor the repair, it will do AML validation again after the repair.

Reprocess: To continue the orchestration of the payment from where it was left, i.e. if the outbound payment had done fraud screening before being stopped because of incorrect interbank settlement date then it will not do fraud screening again.

Return: Generate an outbound payment to return a previous inbound payment. (see more information ´Understanding a Return payment´ below)

FX Input: Allows users to apply or modify foreign exchange (FX) rates for a payment, ensuring accurate currency conversion.

Accept / Reject Recall Request: Answer positively or negatively to a previously received cancellation request (camt.056)

How to take action

From the main navigation, select the Payments tab. click the ´Injured´ tab. A list of all injured payments will be displayed, filtered by urgency and issue type.

Select the Payment:

Click on a specific payment to view its details. A summary of the issue and available actions will be displayed.

Take the Necessary Action:

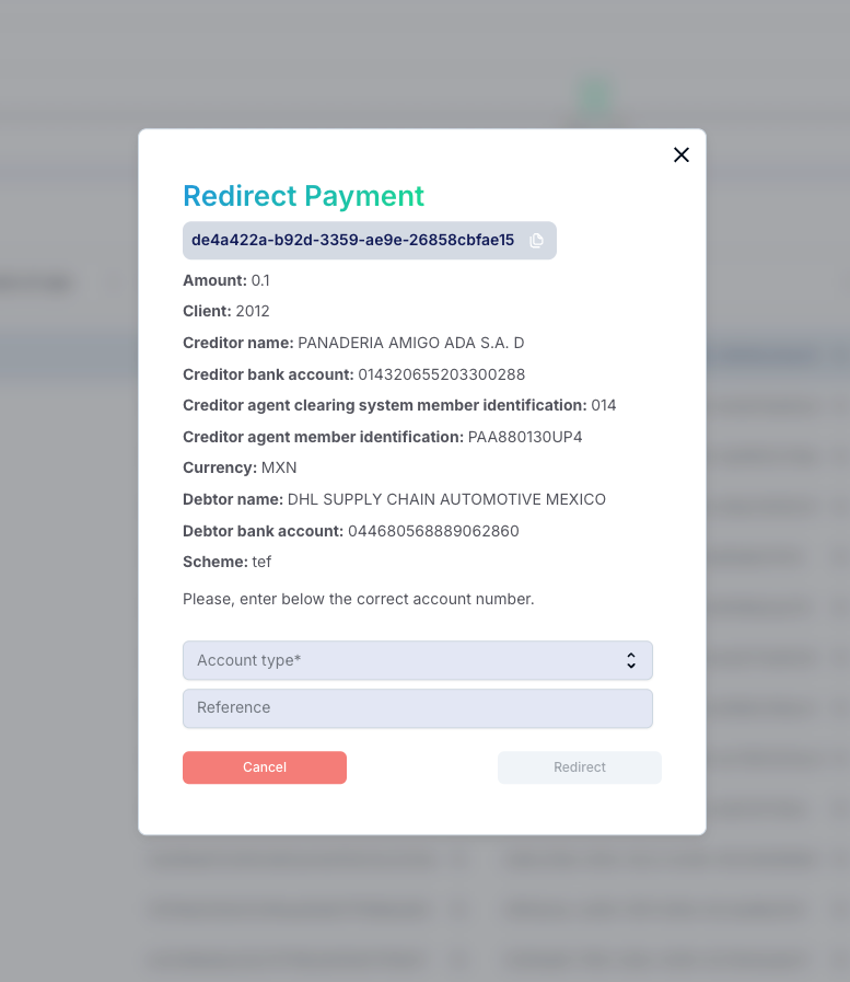

Depending on the payment issue, choose one of the available actions (e.g., Return, Retry, Redirect, Finalise). If modifying fields (Redirect), ensure that all mandatory fields are correctly updated.

Confirm and Submit:

Review the changes or action selected. Click the right hand button at the bottom of the screen to execute the selected operation. A confirmation message will indicate whether the action was successful or if further intervention is required.

Understanding a Return payment

When analysing a Return payment (pacs.004), you will not only view its details but also have the ability to navigate to the original payment it corresponds to.

As always, pressing the “More details” button will direct you to a display of all the data contained within the pacs.004.

This time a “Communication” button will appear. The “Communication” area will show you the corresponding pacs.008 message.

By clicking on the Payment Hub Id of the pacs.008 you will be able to navigate to the payment.

Understanding a Cancellation Request (camt.056)

In some payments rails such as SEPA Credit Transfer. A Cancellation Request (camt.056) for a previous Payment (pacs.008) can be answered with Return (pacs.004). In the Customer Portal you will be able to see all three messages and how they relate to each other.

In the communication area you will be able to navigate through Cancellation Request (camt.056) and if available, its related Return (pacs.004).

Audit and Compliance

All actions performed within the Exception Handler are meticulously logged for auditing purposes. Users can monitor changes, approvals, and rejections in the Audit Section of the payment details view. This process guarantees transparency and accountability in managing payment exceptions.

The Exception Handler is an essential feature that ensures payments are processed efficiently while upholding compliance with both operational and regulatory standards.

User creation

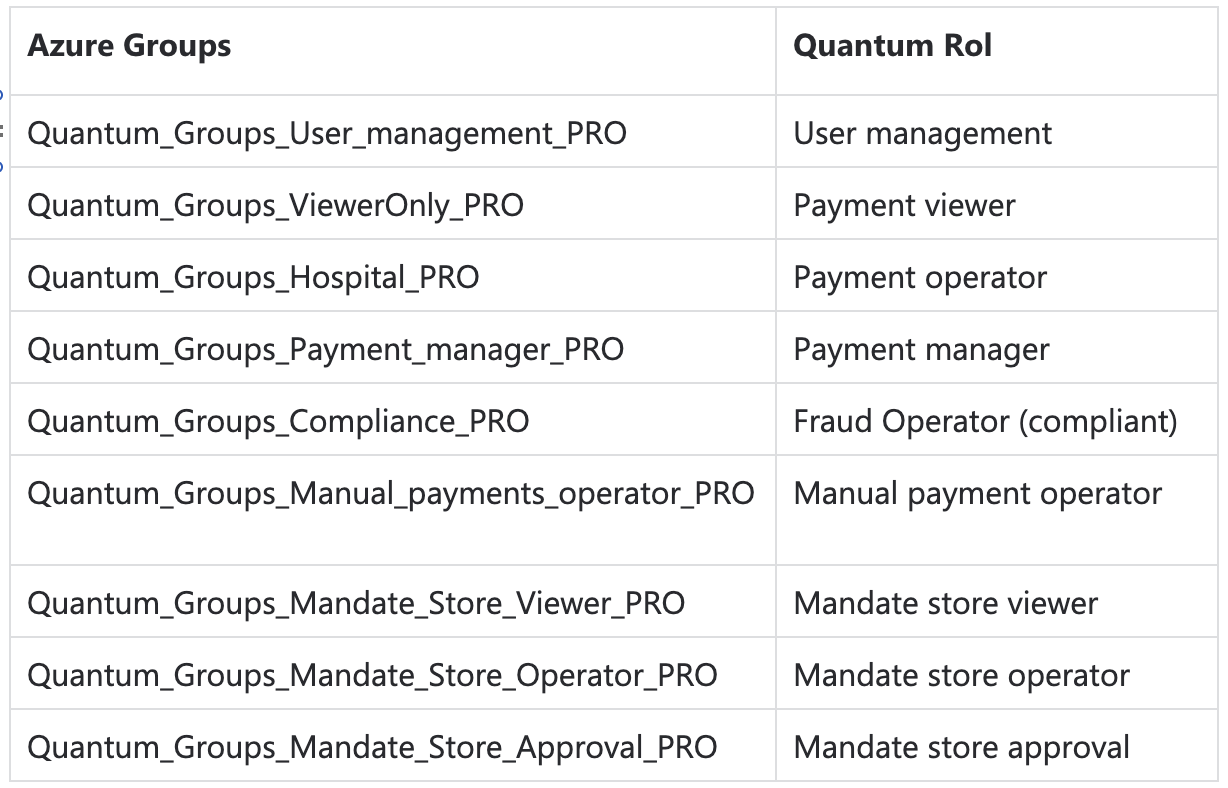

Quantum works integrated with SSO Azure AD. So to access in Quantum, the user will use his corporate mail.

The access in platform is divided in 2 steps

1. gets the role through Azure groups – this is requested by the user or the user’s manager via Sailpoint

2. then grant the access to the Tenant – A Quantum user with user management admin rights can then create the user in Quantum and assign it to the right tenant

If a user does not have a group assigned via Sailpoint or does not have access into a Tenant via Quantum will not be able to use Quantum.

Request access to Quantum groups via Sailpoint

The access to production is managed by Sailpoint, to get access you need to go to Sailpoint. In the left corner click on the menu and then enter in the menu option:

Manage user access

Follow these steps :

Introduce your email and click on next

Introduce the Group you want to acces and click on next. The group would be one of these:

Add a User in the Customer Portal

Only users with a 'User Management' profile can grant access to the Customer Portal. To identify who holds the User Management profile within your team, please consult your PagoNxt Implementation Manager.

Users with Management permissions can add new users by:

· Clicking on the 'Management' icon in the left-hand navigation

Note: The Management icon will only be visible to those with a User Management profile.

· Selecting 'Add New User' in the top right-hand corner

· From the All tenants drop down, select the tenants where you want to assign the new user to:

· Enter the email of the user, and click Confirm

Log out

To log out click the ´Logout´ icon at the bottom of the left hand navigation panel. The portal will automatically log out after 30mins if there has been no activity.

Trouble shooting and support

If you are experiencing problems with login, access to payment information or simply need more information about the tool, please raise a ticket in our help desk and a member of the team will be happy to support you http://help.pagonxtpayments.com