PagoNxt Payments Hub Platform

The PagoNxt Payments Hub is a state-of-the-art payment message processor that operates on high-performance, modern technologies and is built natively in the cloud. It adheres to the ISO20022 standard, which facilitates seamless integration with existing customer services and systems.

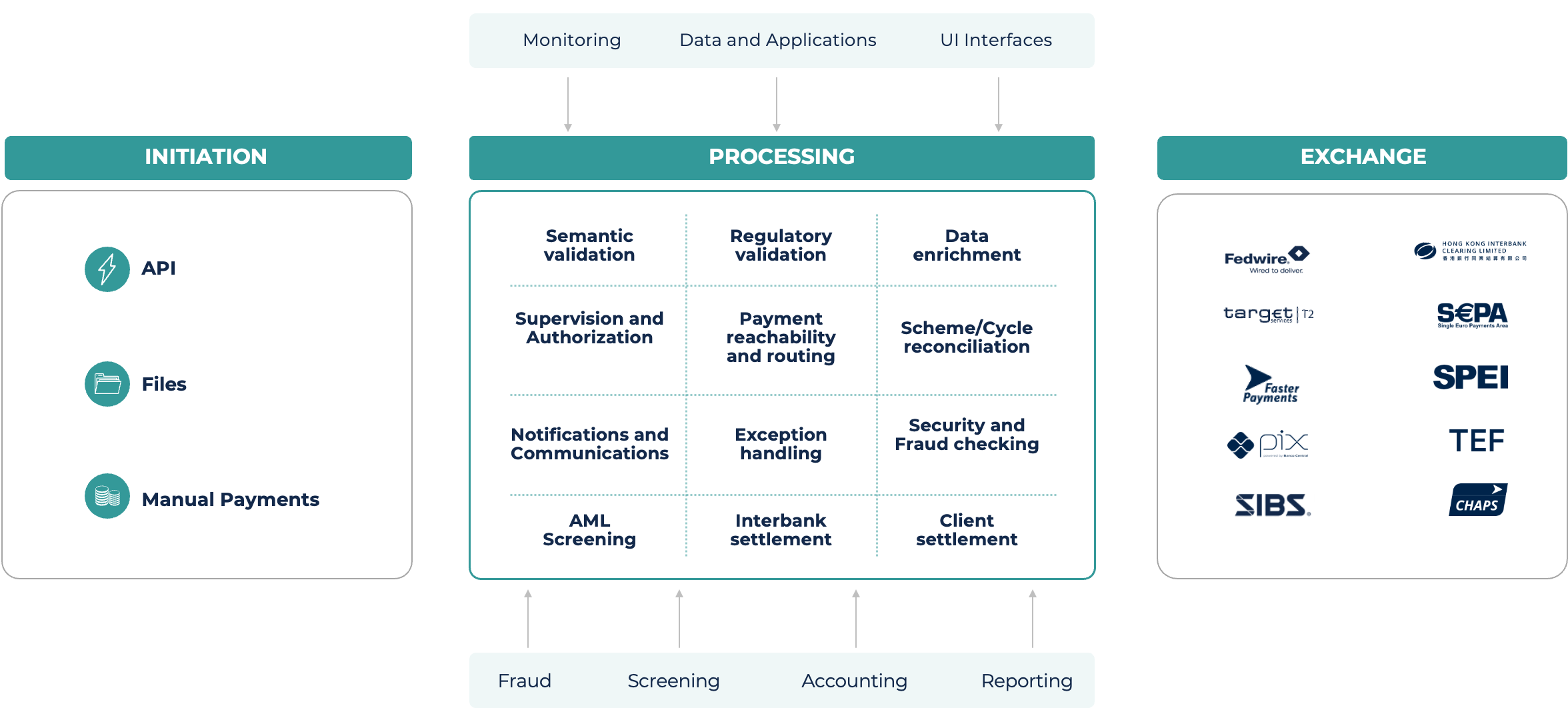

The platform is designed to connect with the customer’s payment initiation systems -i.e., channels- through an ISO-compliant payments initiation interface (please refer to the interface specification for further details). Upon their receipt, the platform orchestrates the execution of those messages based on their type, status, context, and other relevant factors.

Typically, payment messages are exchanged with clearing houses and/or the gateways as per the defined scheme rules. Responses from these clearing houses are received and processed accordingly, and the originating channels are also updated.

The orchestration of payment messages usually relies on some integration with the customer's infrastructure and solutions, particularly other core banking services such as accounting or screening. To facilitate the exchange of information, the PagoNxt Payments Hub offers both generic and specialized interfaces that accommodate various technical configurations.

Technical implementation

PagoNxt Payments Hub’s implementation relies on the following fundamental aspects:

Cloud nativeness: design and development activities started right off in a public cloud environment (AWS), and with all its software components based on microservices.

Single codebase: there is only one version of the software, which makes testing and maintenance easier and efficient and enables a continuous deployment of service enhancements and security updates, reducing implementation risk to a minimum.

Multi-tenancy: different customer types and profiles -e.g., retail and commercial banks, represented entities, corporations, etc.- share infrastructure and services while keeping their context (i.e., data, configurations) isolated.

Performance, resilience, and security by design: the platform is built to support effectively very large volumes of payments while ensuring a 24x7x365 availability, including the volumes of large FIs and systemic banks. This is ensured through techniques such as multi-region deployments, multiple availability zones, and disaster recovery procedures.

Architectural components

The core platform has five architectural components:

Initiation

Processing

Data extraction

Platform interfaces

Third party integrations